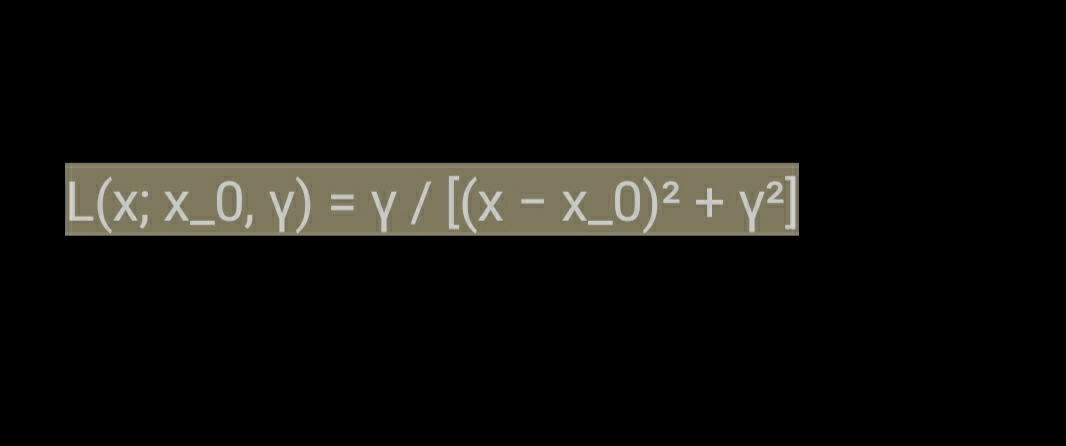

The Lorenzian Function Formula

The Lorenzian function, also known as the Cauchy distribution, is a probability distribution that describes certain physical phenomena, particularly resonance phenomena in physics. The Lorenzian function has the following formula:

L(x; x_0, γ) = γ / [(x − x_0)² + γ²]

where:

x is the independent variable

x_0 is the peak position parameter

γ is the line width parameter, also called the half-width at half-maximum (HWHM)

The formula describes a bell-shaped curve with a peak at x_0 and a width determined by γ. It has a slower decay than the Gaussian distribution, and its tails extend to infinity in both directions. The Cauchy distribution has no finite moments, which means that the mean and variance are undefined.

The Lorenzian function formula is a mathematical formula that is used in trading to model price movements of financial instruments. It is particularly useful in options trading because it can provide an estimate of the probability distribution of future price movements.

In trading, it is important to understand the probability distribution of price movements because this information can be used to make informed trading decisions. Traders can use the Lorenzian function formula to estimate the probability of different price movements and adjust their trading strategies accordingly.

The Lorenzian function formula is also used in other areas of finance, such as risk management and portfolio optimization. Overall, the formula provides a mathematical framework for analyzing financial data and making informed decisions based on that analysis.

Trading algorithms are using Lorenzian function formula because it can help identify patterns in financial data. The formula can be used to model complex systems and can help identify the underlying dynamics of a system. In trading, this can help traders identify trends, predict future market movements, and make informed trading decisions.

For example, the formula can be used to model the volatility of financial assets, which is a key factor in determining the risk and potential reward of an investment. By using the formula to analyze past market data, traders can identify patterns in volatility that may indicate future market movements.

It's also possible that the popularity of using Lorenzian function formula in trading is simply due to its effectiveness in predicting market trends and movements, rather than any specific connection between the formula and trading.

Comments

Post a Comment